Specialized Roof Financing: Mobile Homes, Commercial & More in Arizona

Introduction to Specialized Roof Financing in Arizona

Arizona’s diverse landscapes—from urban Phoenix to rural Show Low—mean roofing needs vary widely, from mobile home coatings to commercial metal installations. Specialized roof financing addresses these niches, offering tailored loans, grants, and plans for unique scenarios such as storm damage, energy upgrades, and commercial properties. With costs for mobile home roofs ranging from $2,000 to $8,000 and commercial projects exceeding $50,000, these options make protection affordable. This guide explores Arizona-specific programs, including those for Pinetop-Lakeside and border areas. At InEx Roofing, we customize financing for your setup—get a free consultation today. For general strategies, see our pillar page: Comprehensive Guide to Roof Financing Options in Arizona.

Why Opt for Specialized Roof Financing?

Standard loans may not fit non-traditional roofs, but specialized options consider factors such as property type or the cause of damage. In Arizona’s monsoon-prone areas, storm-specific aid prevents out-of-pocket costs. Benefits include rebates for eco-friendly materials, flexible terms for businesses, and no-credit-check grants for low-income mobile homes. This financing preserves operations for commercial or residential use for mobiles, with potential tax incentives. However, eligibility varies—rural vs. urban programs differ, and commercial rates might be higher (8-15% APR).

Options for Specialized Roof Financing

Tailored paths for Arizona’s unique roofing challenges.

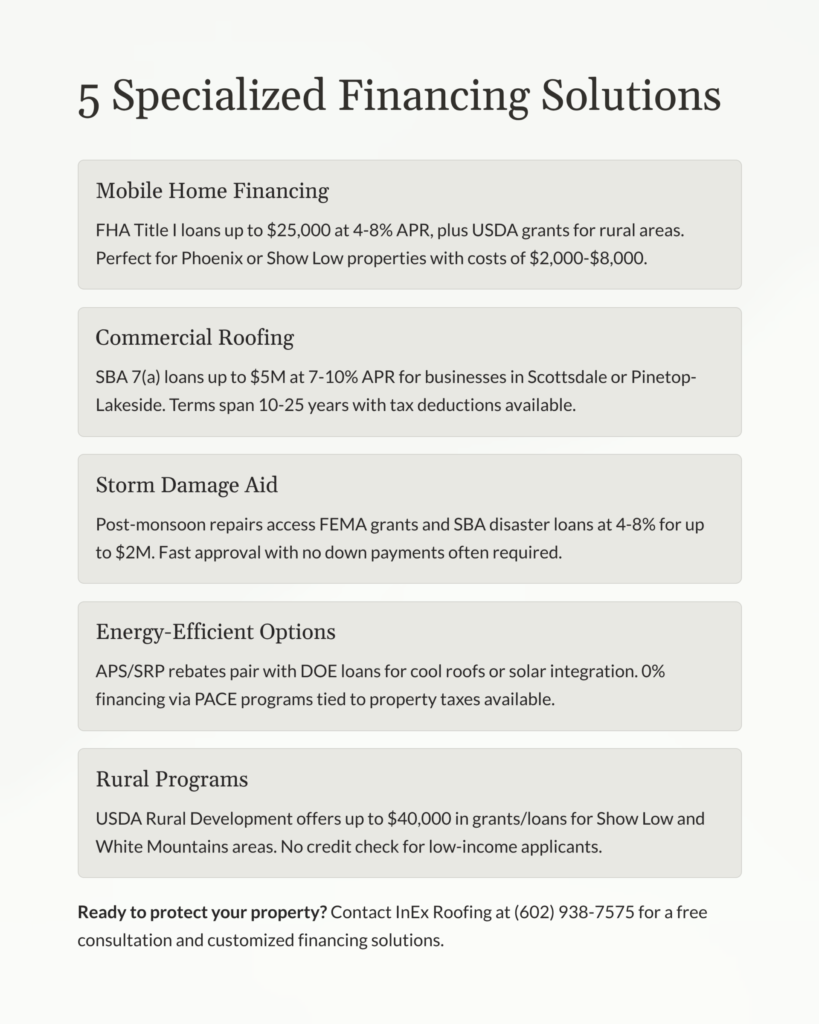

1. Mobile Home Roof Financing

Mobile homes in Phoenix or Show Low qualify for FHA Title I loans of up to $25,000 at 4-8% APR, or USDA grants in rural areas. Coatings for RV/mobile roofs often receive 0% promotions from contractors.

Pros: Low barriers, energy focus. Cons: Property inspections required. For credit issues: How to Get Roof Financing with Bad Credit. Explore HUD Mobile Home Loans.

2. Commercial Roofing Financing

Businesses in Scottsdale or Pinetop-Lakeside use SBA 7(a) loans up to $5M at 7-10% for metal/shingle installs or PACE for energy-efficient flats. Terms are 10-25 years, with tax deductions.

Pros: Large sums, deductible. Cons: Business credit needed. Link to promos: Interest-Free and 0% Roof Financing Plans. Check SBA Loan Programs.

3. Storm Damage and Insurance-Tied Financing

Post-monsoon repairs in Phoenix can be funded through FEMA grants or insurance supplements via roofers, with low-interest SBA disaster loans (4-8% for up to $2M). No down payments often.

Pros: Fast, subsidized. Cons: Claim proof required. For replacements: Roof Replacement Financing: Loans and Programs. See FEMA Individual Assistance.

4. Energy-Efficient and Eco Roofing Options

Arizona’s APS/SRP rebates pair with DOE loans for cool roofs or solar integration, offering 0% financing through PACE, which is tied to property taxes. Ideal for the White Mountains or border areas.

Pros: Savings on bills, green incentives. Cons: Qualifying materials only. For company plans: Roofing Companies with Payment Plans. Visit Energy.gov Financing.

5. Rural and Location-Specific Programs

In Show Low or Pinetop, USDA Rural Development offers up to $40,000 in grants/loans for homes/commercials; no credit is available for low-income applicants. Border options include Utah ties if needed.

Pros: Forgivable aid. Cons: Rural limits. Review USDA Rural Housing.

Steps to Secure Specialized Roof Financing

- Identify needs: InEx assesses your roof type/location.

- Research programs: Use state sites for eligibility.

- Gather docs: proof of damage, income, and property.

- Apply via partners: Roofers streamline.

- Compare terms: Factor rebates/fees.

- Finalize: Ensure warranties.

Pros and Cons of Specialized Roof Financing

Pros: Customized, potential grants, long-term savings. Cons: Strict criteria, longer approvals.

FAQs on Specialized Roof Financing

- Mobile homes eligible? Yes, via FHA/USDA.

- Commercial differences? Larger loans, business focus.

- Storm damage covered? Often via insurance/FEMA.

- Eco rebates? Yes, for qualified upgrades.

- Rural perks? Grants in White Mountains.

- Cross-state? Limited, but options for borders.

Conclusion

Specialized roof financing in Arizona adapts to your unique needs, ensuring durable solutions. InEx Roofing guides you—call (602) 938-7575 for expert help.